The economic evaluation of transferable tax credits typically hinges on the discount rate, which reflects the price buyers are willing to pay per dollar of reduced federal tax liability. However, fixating on the discount alone offers a limited perspective. A comprehensive financial analysis must also factor in the payment terms of the credits and the subsequent effects on estimated tax payments. These elements are crucial as they can substantially influence the Internal Rate of Return (IRR) and Return on Investment (ROI), key metrics used to assess the profitability and efficiency of the tax credit investment.

To illustrate, favorable payment terms could allow a buyer to defer payment, thus preserving cash flow and potentially enhancing the IRR. Conversely, upfront payment could lead to a lower IRR despite a high discount. Moreover, the ability to reduce estimated tax payments through the strategic use of tax credits can improve immediate cash flow, thereby affecting ROI. By taking into account these additional dimensions—payment timing and tax payment impacts—buyers can gain a more nuanced understanding of a tax credit’s true value and its broader implications on their financial health. This multidimensional approach to valuation ensures a more accurate assessment of the economic benefits and strategic advantages of purchasing transferable tax credits.

Returns to Tax Credit Buyers under different payment terms:

In a streamlined transaction scenario, XYZ Corporation, a C-corporation, acquires $500 in tax credits for $460, benefiting from a 12% discount. The corporation has fixed quarterly estimated tax payments due mid-March, June, September, and December. It opts for a tax filing extension, planning to file on September 15 instead of April 15. For this analysis, XYZ’s estimated taxes are based on equal quarterly payments, not on the installment method, simplifying its tax estimation process. This scenario illustrates XYZ’s strategic approach to tax planning and credit utilization to optimize its fiscal responsibilities.

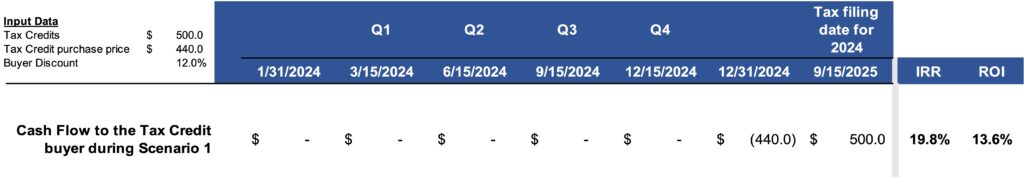

Scenario 1: Sign and close the Transaction at the end of the year with no estimated Tax payment reduction at each quarter

This scenario presents a situation where XYZ Corporation identifies a valuable tax credit opportunity late in the year, specifically in the fourth quarter of 2024. The company quickly moves to secure this opportunity by entering into a Tax Credit Transfer Agreement (TCTA) on the last day of the year, December 31, 2024. On this date, XYZ Corporation commits to the purchase and simultaneously pays $440 for the tax credits, which is completed in tandem with the signing of the TCTA.

Due to the late execution of the tax credit agreement, XYZ Corporation is unable to apply these credits toward reducing its estimated tax payments throughout the year. Consequently, the tax credit’s financial impact is deferred. It is only when XYZ Corporation files its final tax return in September of the following year, 2025, that it reaps the benefits of this transaction. At the time of filing, the company realizes a $500 reduction in its annual federal tax liability due to this tax credit.

The timing of the tax credit purchase significantly influences the financial metrics. The Internal Rate of Return (IRR) on this purchase is calculated at 19.8%, demonstrating a high rate of earnings on the investment when the time value of money is considered. The Return on Investment (ROI), which measures the gain from the investment relative to its cost, is noted at 13.6%. This reflects the profit made from the tax credit as a percentage of the purchase price, albeit without the advantage of quarterly tax payment reductions.

Scenario 1 serves as an example of the effects of timing on tax credit investments. It underscores that while late-year tax credit purchases can still yield considerable returns, the delay in their impact on cash flows and tax liabilities can affect the overall financial performance indicators of the investment

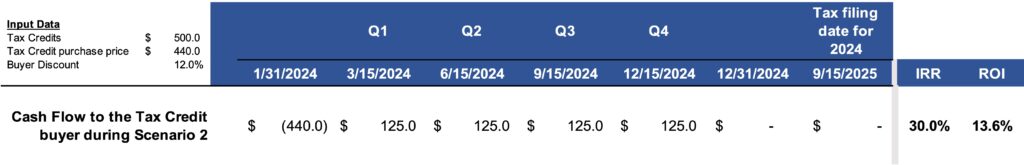

Scenario 2: Sign and close the Transaction at the beginning of the year with an estimated Tax payment reduction at each quarter.

This scenario outlines a proactive financial decision by XYZ Corporation, where the company capitalizes on a tax credit opportunity early in the fiscal year. On January 31, 2024, XYZ Corporation enters into a Tax Credit Transfer Agreement (TCTA). Echoing the process in Scenario 1, the closing of the deal and the payment of $440 for the tax credits are conducted simultaneously with the execution of the TCTA. This immediate action is characteristic of a scenario where a tax credit is generated at the start of the tax year—such as a solar energy project that became operational in January 2024.

With the purchase made early in the year, XYZ Corporation strategically leverages the tax credit to decrease its quarterly estimated federal tax payments. Each quarter, the company reduces its tax payment by $125, cumulatively reflecting an anticipated reduction in its annual federal tax liability by $500.

The financial implications of this preemptive move are significant. The Internal Rate of Return (IRR) for XYZ Corporation on this transaction is an impressive 30%, indicating a robust efficiency of the investment over the period. Meanwhile, the Return on Investment (ROI) remains steady at 13.6%, demonstrating the percentage of the investment gained as profit. This scenario demonstrates the tangible benefits of early investment decisions and savvy financial planning in leveraging tax credits to enhance a company’s financial performance metrics.

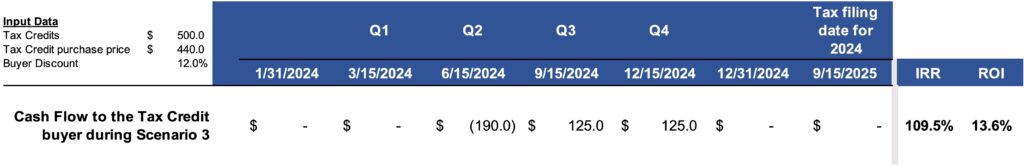

Scenario 3: Sign and close the Transaction in the middle of the year with an estimated Tax payment reduction in the last three quarters.

This scenario depicts XYZ Corporation’s mid-year strategic move to capitalize on a tax credit opportunity. On June 15, 2024, the company enters into a Tax Credit Transfer Agreement (TCTA) and, maintaining consistency with the previous scenarios, finalizes the purchase with a simultaneous payment. This time, the transaction results in a cash outflow of $190, representing the net cost to the company after accounting for the immediate benefit of the tax credit.

XYZ Corporation, having completed the transaction midway through the year, manages to apply the tax credit to the last three-quarters of estimated tax payments. Specifically, the company effectively reduces its second quarter estimated tax payment by $125, equating to half of the total tax credit purchased, and accounts for the savings from both the first and second quarters. Consequently, the net effect of the purchase on June 15 equates to the $190 outflow.

In the ensuing quarters—Q3 and Q4—XYZ Corporation continues to benefit from the tax credit, with a reduction of $125 applied to each quarter’s estimated tax payments. This strategic application of the tax credit leads to a remarkably high Internal Rate of Return (IRR) of 109.5%. It is important to note, however, that as the duration of the investment decreases, the IRR metric becomes increasingly exaggerated and thus may be less reflective of the investment’s actual annualized performance. Despite this, the Return on Investment (ROI) remains consistent at 13.6%, illustrating the percentage of the investment that is recovered as profit, without being disproportionately influenced by the investment’s shortened timeframe.

Scenario 3 underscores the impact of investment timing on the efficiency and returns of tax credit opportunities. It highlights how mid-year actions can yield significant benefits and affect key financial performance indicators, while also noting the limitations of certain metrics when used over shorter investment periods

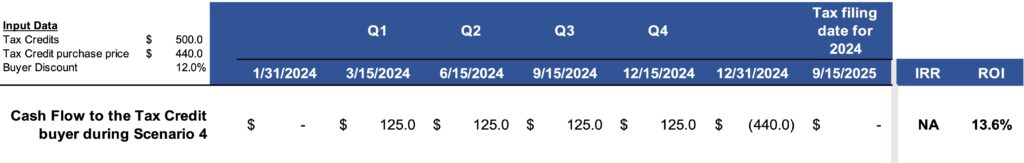

Scenario 4: Sign the Transaction at the beginning of the year and close at the end of the year with an estimated Tax payment reduction at each quarter

This scenario explores a nuanced approach to tax credit transactions influenced by IRS guidelines on estimated tax payments. In this scenario, XYZ Corporation identifies an early opportunity in 2024 involving a solar project slated for completion in December of the same year. In January 2024, the company proactively enters into a Tax Credit Transfer Agreement (TCTA) with the project owner. However, the closing of the transaction is contingent upon the project’s successful completion. Thus, the TCTA serves as a forward commitment to purchase the credits without any immediate financial exchange.

The IRS guidelines released in June 2023 provide a significant advantage for such transactions. They state that a tax credit purchaser may account for a credit portion it intends to buy when calculating estimated tax payments. Leveraging this provision, XYZ Corporation is able to anticipate the tax credit and accordingly reduce its quarterly estimated tax payments throughout the year by $125 per quarter.

This strategic planning, enabled by the IRS’s favorable provision, allows XYZ Corporation to manage its cash flow effectively by deferring the actual payment until December 2024, when the project is completed and the purchase is finalized. The calculated Return on Investment (ROI) for this transaction is maintained at 13.6%, reflecting the company’s consistent percentage gain on the investment. The Internal Rate of Return (IRR) is not applicable in this scenario, possibly due to the unique cash flow pattern where benefits are realized before the actual payment is made.

Scenario 4 highlights how regulatory interpretations can significantly impact financial strategies, particularly in the realm of tax credits. It demonstrates the company’s ability to mitigate cash outlays while still securing the anticipated financial benefits of the tax credit, illustrating a savvy use of tax guidelines to optimize cash flow and investment returns