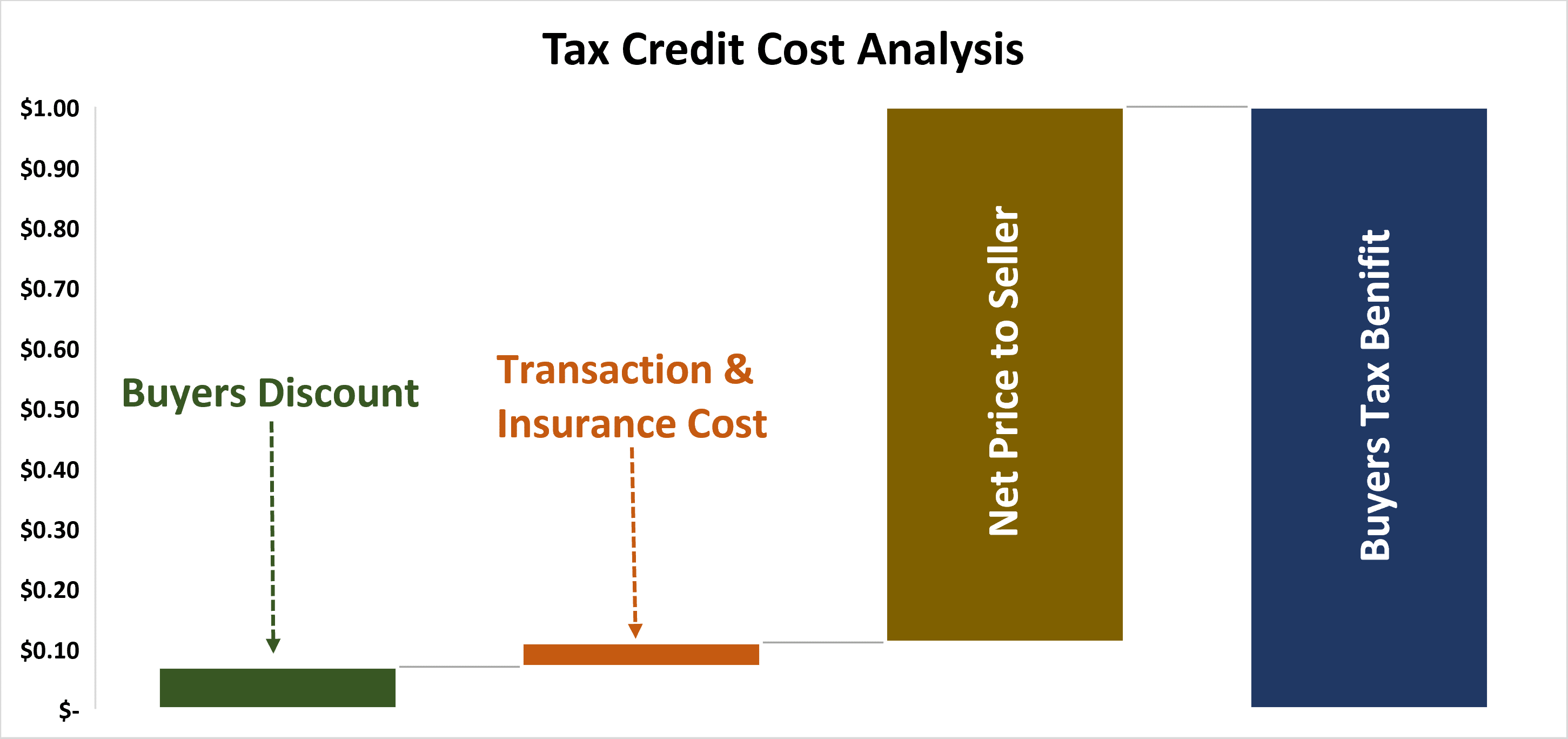

Transferable tax credits are priced at a discount to face value to incentivize the buyer to purchase credits. Tax credit pricing has three major components.

Transaction Cost & Tax credit insurance premium:

The second component in the pricing of transferable tax credits encompasses the transaction costs and tax credit insurance premiums. This portion of the price reflects the operational expenses related to the sale and risk mitigation of the tax credits.

- Direct Transaction Fee:

This fee is paid to the brokers, intermediaries, or platforms that facilitate the sale of tax credits. It covers the services provided in connecting buyers and sellers, managing the transaction, and ensuring compliance with legal and regulatory requirements.

- Tax Credit Insurance:

This insurance protects the buyer against the risk that the tax credits might be disallowed or recaptured in the future. The premium paid for tax credit insurance safeguards the buyer’s investment, providing compensation if the tax credits do not yield the expected financial benefit due to changes in policy, project failure, or other covered events.

Buyer Discount:

The buyer discount is a key element in the pricing of transferable tax credits, representing the markdown a buyer receives from the face value of the tax savings provided by the credit. It’s the gap between the actual cost of the tax credit to the buyer and the nominal dollar of tax savings it represents.

Net Price to Seller:

The net price to the seller is the final amount received from selling transferable tax credits, after deducting all related transaction fees and the cost of tax credit insurance. This sum represents the actual earnings for the project developer from the sale and is the decisive figure for the financial outcome of the transaction.

Driver of Price for Transferable Tax Credits

The following are the major factors that influence the price of transferable tax credits:

Timing (Long-term Commitments vs. Just-in-Time Purchase):

Buyers who are willing to make long-term commitments, such as a five-year commitment to purchase tax credits, are often given larger discounts compared to those who make just-in-time purchases. This is because long-term commitments provide the seller with predictable cash flow and reduce the risk associated with the time value of money.

Credit Worthiness of the Seller:

The creditworthiness of a seller influences the discount rate on tax credits; a high credit rating and reliable transaction history equate to lower risk for buyers, leading to a smaller discount. Conversely, a seller with lower creditworthiness is riskier, necessitating higher discounts to entice buyers. In such cases, the seller may also need to offer tax credit insurance to mitigate the buyer’s risk and make the credits more attractive despite the higher discount.

Payment Terms:

The timing of the receipt of proceeds from the sale of tax credits is a critical factor affecting the discount a seller might offer. If a seller needs immediate cash, they may be willing to offer a larger discount to attract buyers quickly.

Technology Maturity:

The stage of development of the renewable technology involved will influence the buyer discount. Mature technologies with a proven track record may command smaller discounts, as they are considered lower risk compared to emerging technologies.

Type of Tax Credits:

The type of tax credit influences its discount rate due to varying risk levels and market conditions. Investment Tax Credits (ITC) typically carry higher discounts because of recapture risks, where the credit may need to be repaid if the project doesn’t meet certain criteria. Production Tax Credits (PTC) are considered less risky, as they are based on actual energy output, leading to potentially lower discounts. Within PTCs, credits for wind energy projects may differ in value from those for Carbon Capture, Utilization, and Storage (CCUS) or hydrogen projects, affected by factors such as market demand, technological maturity, and regulatory climate. Each of these aspects contributes to the perceived stability and profitability of the tax credits, thus affecting their pricing in the market.

When buyers consider these factors, they can better assess the risks and potential returns of purchasing tax credits, which will in turn inform the discount rate they are willing to accept. Sellers must be aware of these factors as well, as they directly impact the pricing and marketability of their tax credits.

Nice Article