The Investment Tax Credit (ITC) is a federal tax credit available to U.S. taxpayers who invest in renewable energy installations such as solar, wind, energy storage, biogas, microgrid controllers, and geothermal systems. Established to propel the adoption of clean energy, the ITC contributes to lowering the nation’s carbon emissions, fostering economic expansion by creating jobs in the renewable sector, promoting energy self-sufficiency by reducing reliance on fossil fuels, and stimulating innovation in eco-friendly energy technologies. The ITC comprises two key components, each designed to support different aspects of the renewable energy investment process.

- Base Credit: The base credit within the Investment Tax Credit (ITC) scheme acts as the primary incentive for installing renewable energy systems, offering a fixed percentage off the installation cost that taxpayers can deduct from their federal tax liability. This credit is generally available to all qualifying renewable energy projects and is intended to lower initial investment costs, thereby encouraging the adoption of renewable energy on a wide scale.

The Investment Tax Credit (ITC) for renewable energy projects incorporates a base credit ranging from 6% to 30%, contingent upon a project’s fulfillment of specific labor standards. To access the upper tier of this credit, projects are required to compensate workers at prevailing wage levels and engage apprentices through programs sanctioned by state or federal agencies, with comprehensive details provided in my ‘Prevailing Wage And Apprenticeship Requirements‘ post. - Bonus Credits: Bonus credits, in contrast to the base credit, are supplementary incentives that are added on top of the base credit for meeting additional, specific criteria aimed at advancing particular policy objectives. These may include using locally-sourced materials, engaging in labor practices that support fair wages and training, or investing in underprivileged communities, thus promoting not only the growth of clean energy but also addressing broader social and economic goals. Notably, there are three types of bonus credits available under the ITC, each designed to further encourage investments in the renewable energy sector that align with these targeted policy goals:

- Domestic Content Bonus: The domestic content bonus included in the Inflation Reduction Act is primarily aimed at bolstering the U.S. economy by promoting the use of American-made materials and components in renewable energy projects. This initiative is expected to enhance local manufacturing, create jobs across various sectors, reduce reliance on imported materials, and foster national energy independence. Consequently, these measures are anticipated to stimulate economic growth, reinforce the resilience of U.S. supply chains, and improve the competitive edge of American industry in the global market.

To qualify for an additional 10% Domestic Content Bonus credit, renewable energy projects are required to satisfy criteria across two specific categories of domestic content, namely Steel and Iron, and Manufactured Products.- Steel and Iron:

- All structural steel or iron products must be produced in the United States.

- This category includes steel for photovoltaic module racking, piling or ground screws, and rebar in the foundation.

- Manufactured Products:

- The following items are categorized under Manufactured Products:

- PV modules

- PV trackers

- Inverters

- PV Module Components: The components of a PV module encompass:

- Photovoltaic cells

- Mounting frames or back rails

- Glass

- Encapsulant

- Back sheet

- Junction box, including pigtails and connectors

- Edge seals

- Pottants

- Adhesives

- Bus ribbons

- Bypass diodes

- A progressive percentage of the total cost of manufactured products, including components used in the facility, must originate from the U.S.

- The required percentage for domestic content scales up as follows:

- 40% for projects starting before 2025

- 45% for projects starting in 2025

- 50% for projects starting in 2026

- 55% for projects starting after 2026

- The following items are categorized under Manufactured Products:

- Key Considerations:

- A product is classified as domestic only if it is manufactured within the U.S. and all its components are of U.S. origin.

- The origin of subcomponents is not considered in this classification. For instance, the origin of a PV cell is relevant, but not the origin of the PV wafer used to produce the cell.

- Products or components manufactured or mined outside the U.S. are designated as “non-U.S. manufactured products.”

- Only the costs of domestically manufactured or mined components count towards the Domestic Content Bonus requirements, excluding the labor costs for manufacturing.

- Steel and Iron:

- Energy Community Bonus: The Energy Community bonus is designed to stimulate investment in regions adversely affected by the decline of the fossil fuel industry. Its objectives are to catalyze economic regeneration, job creation, and new opportunities in areas where conventional employment has diminished due to energy sector transitions, as well as to address environmental degradation by promoting the cleanup and redevelopment of contaminated or abandoned sites, contributing to a revitalized and ecologically sustainable community environment.

Projects may be eligible for an additional 10% Energy Community Bonus if they fulfill at least one of the following criteria:- Brownfield Sites: Areas contaminated by hazardous substances, pollutants, or contaminants, excluding petroleum. This includes lands marred by previous mining activities.

- Economically Affected Areas: Regions that, post-2009, had either a minimum of 0.17% direct employment or derived 25% or more local tax revenue from the coal, oil, or natural gas sectors. These areas must also have an unemployment rate at or above the national average from the previous year.

- Post-Industrial Sites:

- Census tracts where coal mines were closed after 1999, including adjacent trackts.

- Locations where coal-fired power plants were retired post-2009.

- Low-Income Bonus: The introduction of a low-income bonus in the Inflation Reduction Act is intended to democratize access to clean energy for low-income communities in the U.S., offering them tangible financial benefits. This initiative is anticipated to reduce energy expenses for economically disadvantaged families, improve health outcomes by lessening environmental pollution, and foster job creation and workforce development. The overarching impact would be enhanced environmental justice, economic upliftment, and increased participation of low-income communities in the burgeoning green economy. Projects aiming to secure the low-income bonus must have a capacity less than or equal to 5MW. The total allocated bonus is subject to an annual cap of 1800MW, which is apportioned among four distinct categories:

- Category 1: Low-Income Community Projects – Projects situated in a designated Low-Income Community are eligible for a 10% bonus credit, with a total allocation of 700MW.

- Category 2: Indian Land Projects – Projects located on Indian Land can receive a 10% bonus credit, with an allocation of 200MW.

- Category 3: Low-Income Residential Building Projects – Projects classified as Qualified Low-Income Residential Building Projects are eligible for a 20% bonus credit, with 200MW allocated for this category.

- Category 4: Low-Income Economic Benefit Projects – Projects identified as Qualified Low-Income Economic Benefit Projects are eligible for a 20% bonus credit, with 700MW set aside for such projects.

- Domestic Content Bonus: The domestic content bonus included in the Inflation Reduction Act is primarily aimed at bolstering the U.S. economy by promoting the use of American-made materials and components in renewable energy projects. This initiative is expected to enhance local manufacturing, create jobs across various sectors, reduce reliance on imported materials, and foster national energy independence. Consequently, these measures are anticipated to stimulate economic growth, reinforce the resilience of U.S. supply chains, and improve the competitive edge of American industry in the global market.

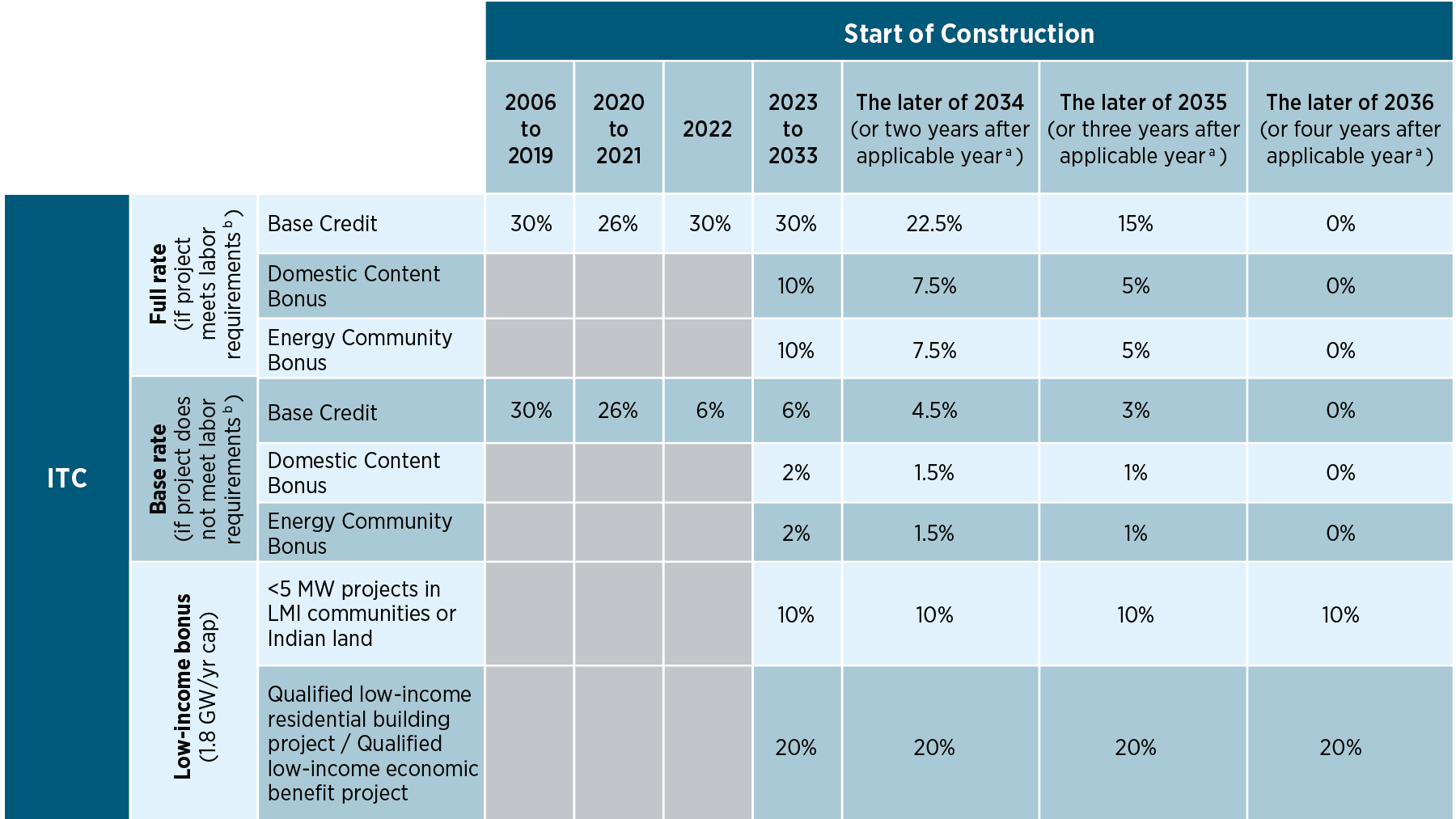

The following table outlines the distribution of Investment Tax Credit components scheduled for allocation to various projects over time

Summary of Investment Tax Credit (ITC) Values Over Time